As we approach the Easter holidays in 2025, the hotel industry is poised for significant growth in occupancy rates and revenue per available room (RevPAR). Here’s a detailed analysis of the expected trends and the factors driving this positive outlook, along with potential risks that could impact the market.

Occupancy Rates

Occupancy rates are projected to improve as travel demand rebounds. With a forecasted increase of 23 basis points, hotels can expect fuller rooms during the Easter holiday period. Several factors contribute to this trend:

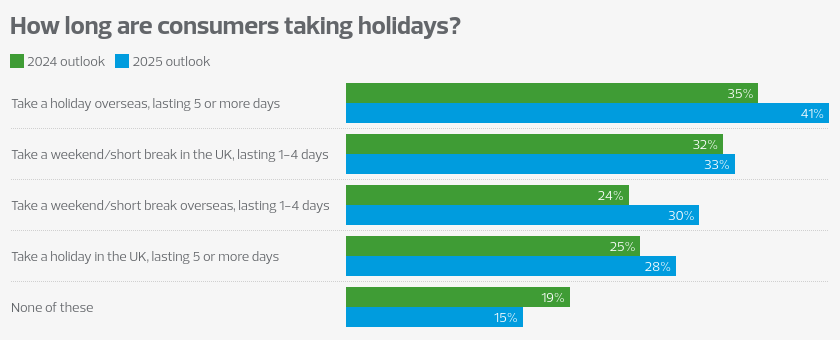

- Increased Travel Demand: Both domestic and international travel is witnessing a resurgence. According to the International Air Transport Association (IATA), there has been double-digit growth in revenue passenger kilometers in early 2024, signaling strong consumer interest in travel. This trend is expected to carry over into the Easter holidays.

- Consumer Preferences: A shift towards leisure travel, coupled with a desire for unique experiences, is driving bookings. Many travelers are seeking out destinations that offer cultural, historical, and recreational activities, making Easter an attractive time to travel.

- Events and Attractions: The Easter holiday often coincides with various events and festivals, which attract visitors. Hotels located near popular attractions or hosting special events can expect higher occupancy rates as travelers seek convenient accommodations.

- Railway Sector Insights: The railway sector is also experiencing a resurgence, with increased bookings for scenic and long-distance train journeys. This trend complements hotel stays, as travelers often combine train travel with hotel accommodations for convenience.

Revenue per Available Room (RevPAR)

RevPAR is expected to see a 2% increase in 2025, indicating a healthy recovery for the lodging industry. This growth can be attributed to several key factors:

- Higher Average Daily Rates (ADR): With the average daily rate projected to rise by 1.6%, hotels can capitalize on increased demand by optimizing pricing strategies. This upward pressure on rates reflects the willingness of consumers to pay more for quality accommodations and experiences.

- Shift Towards Premium Offerings: There is a growing preference for luxury and mid-market hotels, as travelers are increasingly “trading up” in their accommodation choices. This trend is likely to enhance RevPAR as these segments typically command higher rates.

- Business and Group Travel Recovery: The return of business travel and group bookings is a significant driver of RevPAR growth. As companies resume in-person meetings and events, hotels are likely to see increased occupancy and revenue from corporate clients.

- Sustained Demand for Unique Experiences: Travelers are seeking out hotels that offer unique experiences and personalized services. This demand for differentiated offerings allows hotels to justify higher pricing, contributing to increased RevPAR.

- Planned Holidays and School Breaks: The timing of Easter coincides with school holidays in many regions, further boosting travel. Families often plan vacations around this time, leading to increased bookings in hotels catering to family-friendly experiences.

Economic Factors and Risks

The broader economic environment plays a critical role in shaping occupancy and RevPAR trends, but several risks could impact this positive outlook:

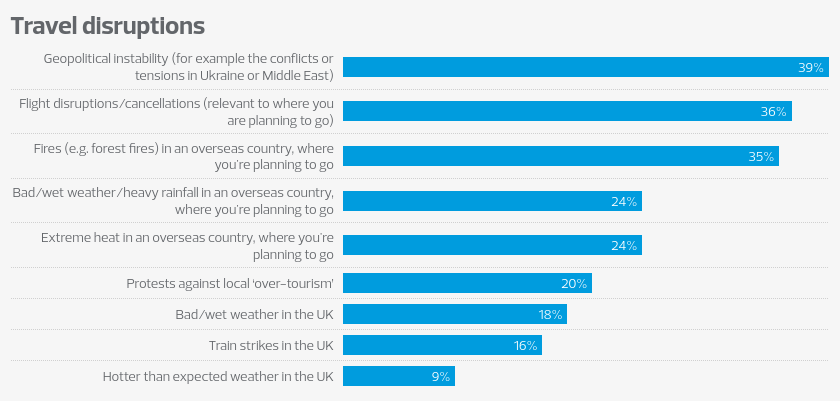

- Geopolitical Tensions: The ongoing war in Ukraine has created instability in Europe and could influence travel patterns. Heightened awareness of safety and risk may deter some travelers, impacting occupancy rates in certain regions.

- Inflationary Pressures: With average inflation expected at 2.5%, rising costs could affect consumer spending habits. Higher prices for goods and services may lead travelers to cut back on discretionary spending, including travel and accommodation.

- Supply Chain Disruptions: Ongoing supply chain issues, exacerbated by geopolitical tensions, could lead to increased operational costs for hotels, affecting profitability.

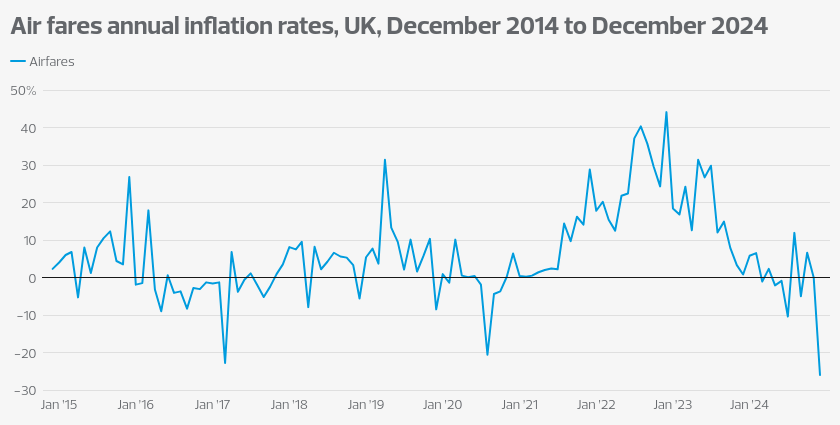

- Airfare Trends: Recent reports indicate a decrease in airfare inflation, with prices dropping by 26% in December 2024 compared to the previous year. While lower airfare costs are likely to stimulate demand for international travel, any sudden changes in fuel prices or airline operational disruptions could impact this trend.

- Economic Uncertainty: A potential recession or economic downturn could dampen consumer confidence and spending. If economic conditions worsen, travelers may prioritize essential expenses over leisure travel.

In summary, the Easter holidays in 2025 are set to be a pivotal moment for the hotel industry, with occupancy rates and RevPAR showing promising growth. Factors such as increased travel demand, a shift towards premium accommodations, the recovery of business travel, and planned holidays will drive this trend. However, risks including geopolitical tensions, inflationary pressures, and economic uncertainty could pose challenges. Hoteliers should prepare for this anticipated surge by optimizing their pricing strategies and enhancing guest experiences while remaining vigilant to potential market disruptions to ensure a successful holiday season.