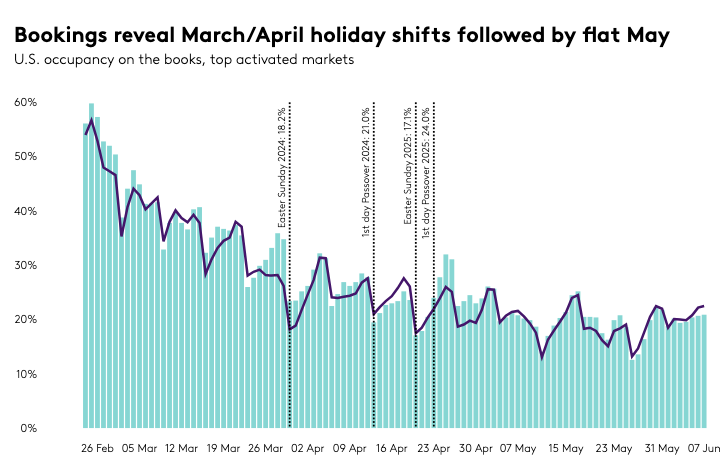

In the first week of March 2025, the U.S. hotel industry experienced flat performance, with a modest increase of 0.6% in Revenue Per Available Room (RevPAR). Contributing factors to this stagnation included lower Transportation Security Administration (TSA) volumes due to the onset of Lent and a delayed spring break, alongside uncertain impacts from U.S. border travel flows.

Global Slowdown

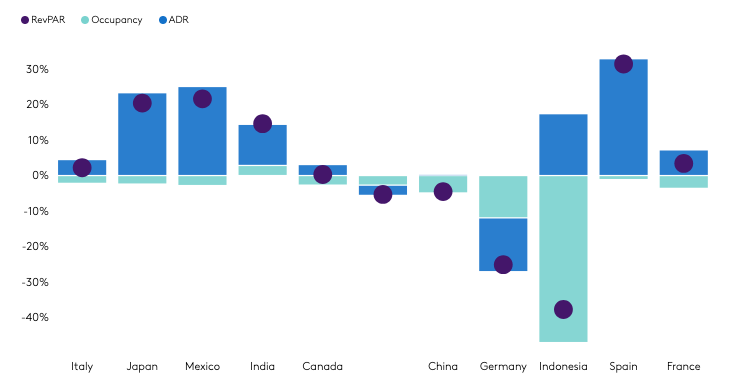

Globally, occupancy rates (excluding the U.S.) fell to 61.2%, a decrease of 4.8 percentage points. Despite this, Average Daily Rate (ADR) saw a rise of 7.3%, leading to a slight decline in RevPAR of 0.5%. Day-of-week occupancy patterns revealed a significant drop of over 5 percentage points from Tuesday to Thursday, with lesser declines on other days. However, ADR increased across all days.

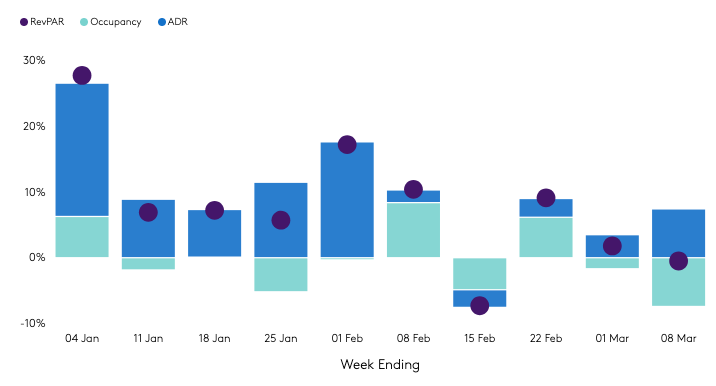

Strong Start, Weak Finish: Flat RevPAR in the U.S.

The U.S. hotel industry reported a modest 0.6% increase in RevPAR for the first week of March 2025. The week began on a strong note, with year-over-year RevPAR growth exceeding 3%, but this momentum waned towards the end of the week. The decline can be attributed to the beginning of Lent and a later spring break, which resulted in decreased TSA volumes.

Among the top 25 markets, cities like New Orleans, Nashville, Los Angeles, and Denver initially reported double-digit RevPAR gains, only to see declines later in the week. Conversely, Chicago and Anaheim (Orange County) benefitted from conventions, experiencing notable double-digit RevPAR growth.

In terms of chain scale performance, the Luxury segment continued to lead for the eighth consecutive week, achieving a RevPAR increase of 4%, largely driven by ADR growth. However, group demand in both Luxury and Upper Upscale hotels dropped by 1.2%, even as ADR rose by 5.2%.

Investigations into the effects of tariffs on U.S. border markets yielded inconclusive findings. The impacts of recent wildfires in Los Angeles and hurricanes in the Southeast are gradually diminishing, while global occupancy rates (excluding the U.S.) have slowed to 61.2%.

As the industry prepares for peak spring travel, highlighted by events like March Madness and spring break, some uncertainties loom. These include potential reductions in federal government support and declining consumer confidence. Nonetheless, outbound U.S. travel in February showed an upward trend, offering a positive outlook for the global hotel industry.